Green Dot Mobile Check Deposit Limit

Personalized card limits and other requirements apply.

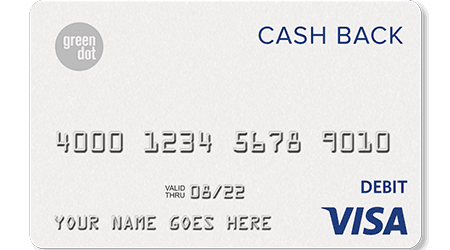

Green dot mobile check deposit limit. Deposits under any of these trade names are deposits with green dot bank and are aggregated for deposit insurance coverage. Active personalized card required. Gobank green dot bank and bonneville bank. Bank pnc bank capital one hsbc bank usa td bank discover synchrony.

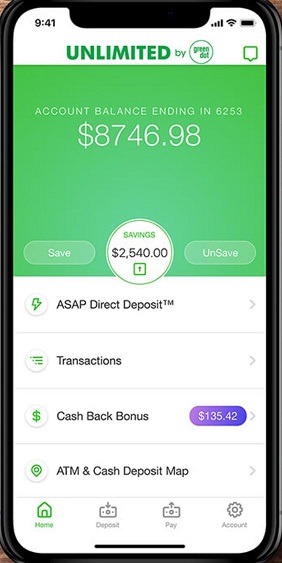

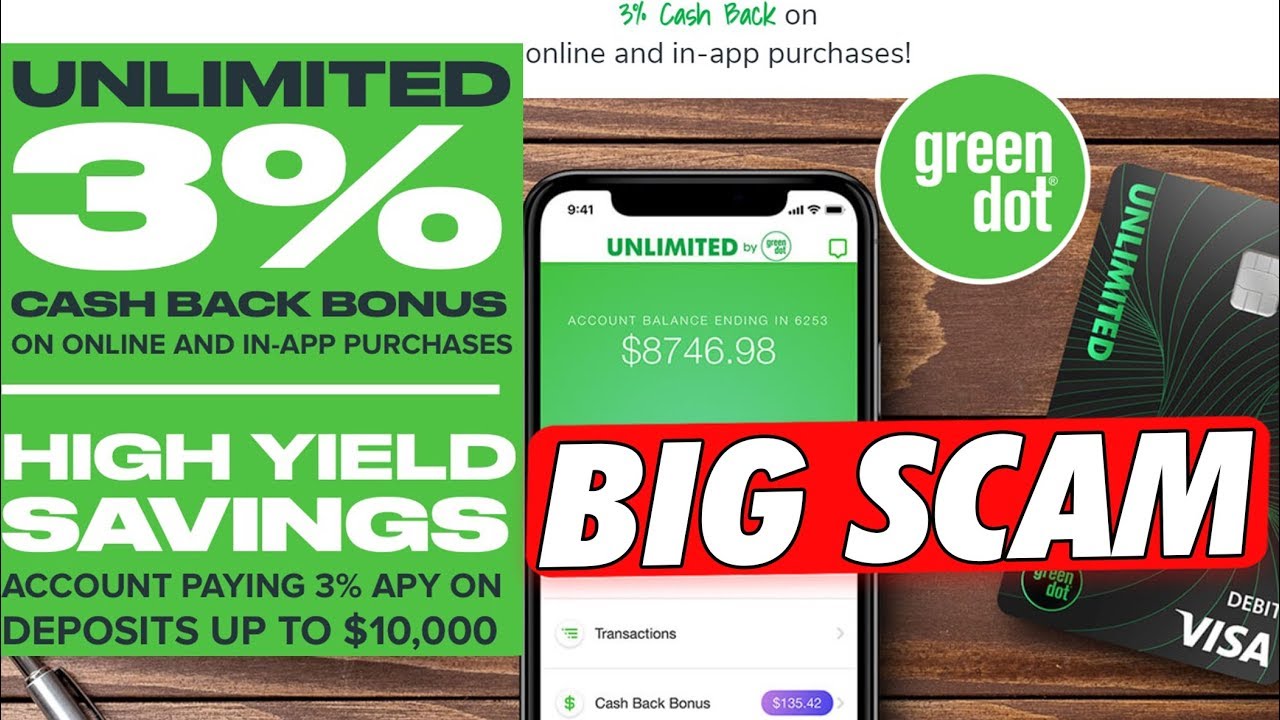

Free cash deposits using the green dot app at participating retailers. Financial accounts to fund. This includes the unlimited cash back bank account by green dot bank a new kind of mobile bank account to help you earn and save more. Using the green dot app learn more about generating a secure deposit code reload the register learn more about reload the register moneypak learn more about moneypak.

Optional services features or products like using mobile deposit may require additional customer verification. Claim the cash back bonus after 12 months of use and your account being in good standing. Financial institutions including chase bank of america citi wells fargo american express u s. Optional services features or products like send money may.

The td bank mobile check deposit limit for customers with accounts opened for 3 to 6 months is 1 000 per day and 2 500 per rolling 30 day period. You can also use the green dot mobile app to deposit your checks. Deposit your money your way with a green dot account you can quickly deposit money whenever you want. 1 most debit prepaid and credit card accounts issued by hundreds of u s.

Active personalized card required. No it is not possible to deposit cash to a green dot card using an atm. From adding cash to your card at midnight to receiving your paycheck up to two days earlier 1 you ll be able to add money how you want. For customers with accounts opened for 6 to 12.

Green dot bank operates under the following registered trade names. Free in network atms nationwide. Already depositing checks with your smartphone. The green dot app is designed to help you manage any green dot debit card or bank account.

The ingo money app may be used by identity verified customers to cash checks issued on u s. All of these registered trade names are used by and refer to a single fdic insured bank green dot bank. Additional customer verification may be required. Keep using the green dot mobile app you know and love to deposit your checks.

We have 3 convenient ways to deposit cash to your card. If you re not using green dot bank you could be missing out on hundreds of dollars per year. Easily transfer money to anyone who has a green dot account.